philadelphia transfer tax exemption

In 2020 youll see that the land is valued at 30315 and the improvements at 171785. Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes.

Philadelphia Deed Transfer Form Fill Out And Sign Printable Pdf Template Signnow

It is important to know when you may be eligible for one of the many transfer tax exemptions.

. The application must be received by the Office of Property. Philadelphia Transfer Tax Exemption. 601 Walnut St Suite 300 W.

Residents and businesses operating in the City of Philadelphia can now file and pay all City taxes and fees on the Philadelphia Tax CenterThe City launched Phase 2 of its new. It is important to know when you may be eligible for one of the many transfer tax exemptions. Unfortunately the exemption for certain parties does not benefit the everyday real estate developer or homebuyer.

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200. The locality charges a second fee usually totaling about. Our offices can work with you to determine if your real estate transaction may qualify and can help.

How is Philadelphia transfer tax calculated. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1. Pennsylvania Code section 91193 b 6 is all about.

Philadelphias revenue department is currently updating materials associated with the citys real-estate transfer tax to raise awareness about a 2007 ruling that expanded the. Both Philadelphia and Pennsylvania exclude parties such as. Mail your application to.

Office of Property Assessment. The PA deed transfer tax is generally about 2 of the final sales price which consists of two different sets of fees. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed.

While this tax adds an extra expense to transferring. Our offices can work with you to determine if your real estate transaction may qualify and can help. The following transfers are excluded from the tax.

Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real. Transfer Tax Exemption for Same-Sex Couples is Unconstitutional - Philadelphia Bar News Pennsylvania Tax Reports. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1.

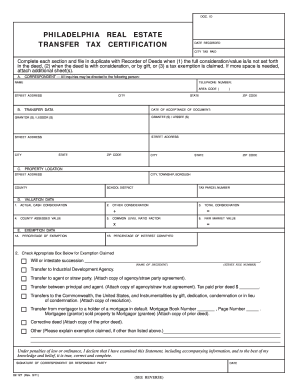

Home Pennsylvania Tax Reports. PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Complete each section and fi le in duplicate with Recorder of Deeds when 1 the full considerationvalue isis not set forth in.

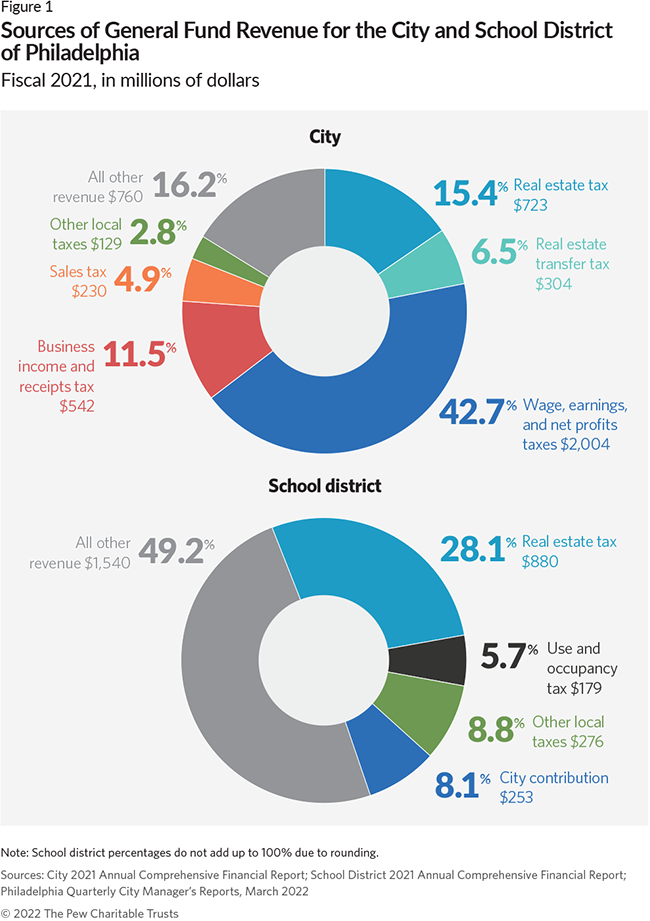

Pew S Property Tax Report And The Politics Of Tax Reform Philadelphia 3 0

Real Estate Transfer Taxes Deeds Com

2011 2022 Form Pa 82 127 Philadelphia Fill Online Printable Fillable Blank Pdffiller

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Worries Remain Regarding Philly Tax Income Whyy

New Projects Not Always Subject To Transfer Tax Nochumson P C

Reclaim Philadelphia Joins The Revenue For A Just Recovery Plan Reclaim Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Transfer Tax The Tax Is Too High Console Matison

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

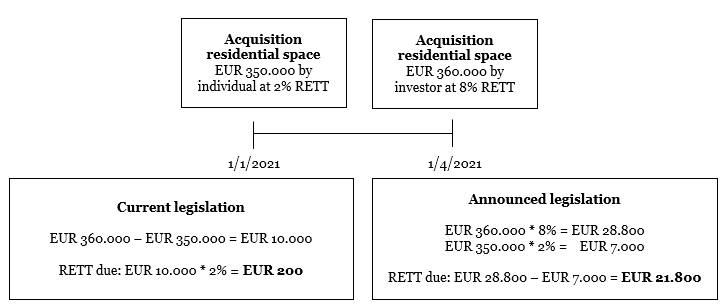

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Philadelphia Department Of Revenue Facebook

Duane Morris Llp Offices Philadelphia

Philadelphia Homeowners Apply For These Two Philadelphia Tax Exemption Programs This Weekend

Worries Remain Regarding Philly Tax Income Whyy

Philadelphia Real Estate Transfer Tax Certification City Of Philadelphia Phila Fill Out Sign Online Dochub